Success story

Seamless and familiar authentication for customers

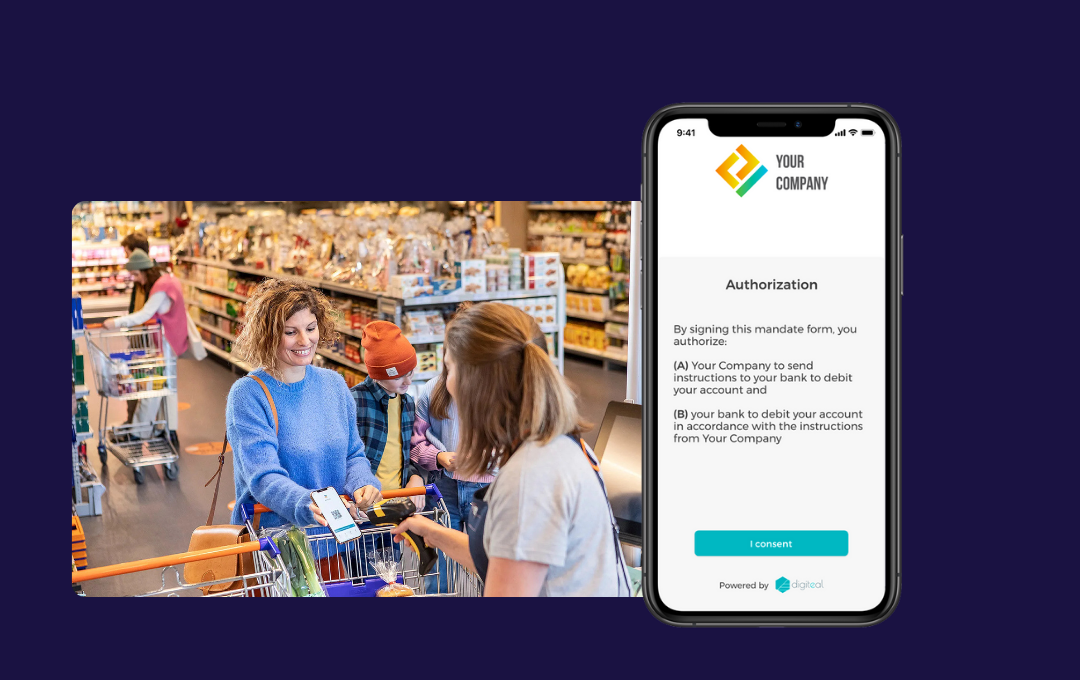

Customers can easily authenticate themselves in a trusted environment: their own banking app. This offers a secure and intuitive experience.

Success story

“We see that the number of successful activations has increased tremendously since Colruyt Group implemented Digiteal’s solution. Customers appreciate the speed and fully trust the process. In addition, we continue to work with Digiteal to further crack down on fraud. Thanks to Digiteal, we are able to intervene faster and are also assisted by a very experienced team.”

Colruyt, one of Belgium’s largest retail groups, is constantly innovating to provide the best possible customer experience. As part of its commitment to customer-centric solutions, Colruyt offers Xtra, a loyalty and payment program/app designed to create an exceptional and rewarding shopping journey.

To complement its offering of payment services, Colruyt wanted to give its customers the opportunity to use Xtra for quick and efficient in-app payments, linked directly to their customers’ bank accounts through SEPA Direct Debit mandates.

However, ensuring a frictionless yet secure authentication process for SEPA mandate creation posed a challenge. Traditional methods (such as signed paper mandates, electronic signature apps, payments of 0,01€,…) lacked the necessary security, ease of use and customer trust.

Colruyt needed a solution that would:

1Ensure an intuitive onboarding process for payment authentication so that customers could pay easily through the Xtra app

2Provide reliable identity verification

3Use state-of-the-art fintech solutions while keeping the process simple and integrated

Digiteal provided an innovative SEPA mandate creation solution by integrating its SEPA Direct Debit Authorization API into the Xtra app. The unique aspect of the proposed solution is that customers authenticate themselves using their preferred banking application. Instead of relying on traditional signature-based authentication, the system securely verifies the IBAN and customer identity through PSD2-compliant mechanisms. The bank connectivity infrastructure has been jointly built with our open-banking partner.

This approach ensures that the right customer is onboarded without additional friction and that secure banking data verification minimizes risks.

Customers can easily authenticate themselves in a trusted environment: their own banking app. This offers a secure and intuitive experience.

The ability to verify customer identity through bank authentication provides additional trust that the right individuals are being onboarded in the Xtra app.

Would you like to offer a safer, faster and more integrated payment experience through SEPA Direct Debits and authenticated mandate creation via your customers’ banking app? Contact us! Our team will explore the best opportunities with you.

COMPANY

Digiteal SA

BE 0630675588

LEI 9845000A44AB9CA60605

Rue Emile Francqui 6/9

1435 Mont-Saint-Guibert

Belgium

ABOUT DIGITEAL

How BILLY empowers freelancers with Peppol e-invoicing

Scroll to top

How BILLY empowers freelancers with Peppol e-invoicing

Scroll to top